How Much Rent Can I Afford?

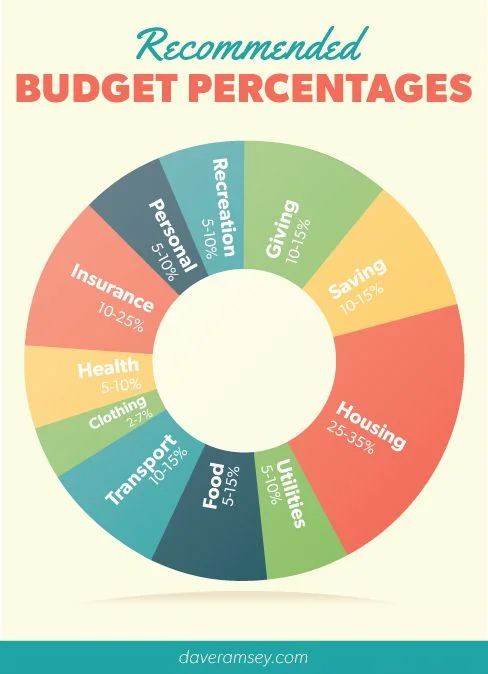

The conservative rule is that your rent or mortgage should not be more than 25% of your income. Others claims your rent should be no more than 30%. Whether or not this figure makes you cringe, there are some additional costs you should take in to consideration before establishing a budget. Expenses are added on once the apartment complex gets you in the door, and all of them should be included in this 25-30% rent to income ratio.

Here are some added expenses to consider:

1. Cable & Internet

If cable is not included in your base rent, add on another $50-$60. If neither cable or wifi are included, add on $90-$150.

2. Trash

Yes, trash. With a dumpster behind the apartments, my friend never expected a trash service fee to come with his monthly bill. Sure enough, there was another $20 a month for someone to pick up trash placed outside doors every evening.

Follow along on Instagram @bethanymitchellhomes

3. Water (and the administrative cost)

"Water is dirt cheap," I was told once. True. My friend's water bill came in at a whopping $4.37 last month. However, don't forget to calculate in another $15 administrative cost for, well, I don't know.

4. Insurance

Add $10-$15 a month for renter's insurance required by most apartment complexes.

5. Parking

Some apartments have parking spaces but require you buy a pass. Others allow you to rent out a single car garage for $100-$200 a month.

Mortgage lenders even require house payments to be less than 28% of your gross income. Do the same for your rent and be prepared with a budget before signing the lease!

Looking for more real estate tips? I specialize in finding great Realtors across the county. If you're in Charlotte, NC, I'd love to help. If not, let me find you a great Realtor in your area!